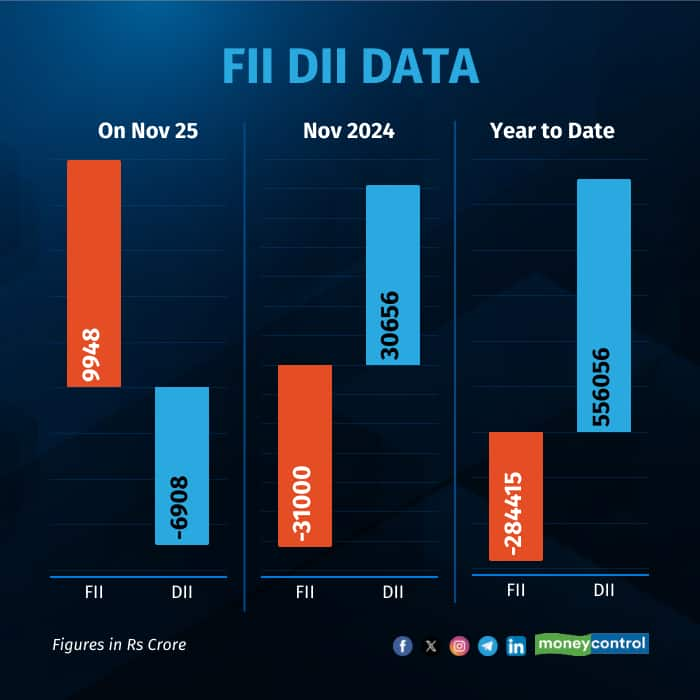

After 38 consecutive sessions of selling, FIIs are back and are seem to be bullish on Dalal street after both benchmark indices gained on positive market sentiment post the elections in Maharashtra. Domestic institutional investors (DIIs) net sold shares worth Rs 6,908 crore, while on the other hand, foreign institutional investors (FIIs) net bought shares worth Rs 9,948 crore, provisional data from NSE showed. DIIs turned net sellers after consistently buying for 13 straight sessions. It is a simple game of supply-demand. It was evident that if FIIs are leaving India then on return there will be a price to pay. It is just a start of another Bull run which might get some ups and downs but this ride is going to be very favourable for the investors as FIIs have now started pouring money in the market.

During the trading session, DIIs bought Rs 17,625 crore and sold shares worth Rs 24,533 crore, and FIIs purchased Rs 85,252 crore in shares while offloading equities worth Rs 75,305 crore.

For the year so far, FIIs have net sold Rs 2.84 lakh crore, while DIIs have net bought Rs 5.56 lakh crore worth of shares. FIIs sold Rs 11,414 crore worth shares in the last week passing by, taking the total selling to Rs 1.55 lakh crore since October.

At close, the Sensex was up 992.74 points or 1.25 percent at 80,109.85, and the Nifty was up 314.60 points or 1.32 percent at 24,221.90.

HDFC Bank was one of the biggest gainers today post the MSCI (Morgan Stanley Capital International) index rejig due to the much anticipated increase in its weightage, which was expected to bring in an estimated $1.88 billion of passive inflows. MSCI had announced this weightage adjustment earlier this year, implementing it in two stages. The August rejig was estimated to bring in $1.8 billion in foreign inflows. Shares for HDFC closed at Rs 1,785.6, up 2.3 percent. Other stocks expected to bring in flows include Kalyan Jewellers, Alkem Laboratories and Oberoi Realty.

ONGC, BPCL, Bharat Electronics, SBI, and L&T were among the top gainers on the Nifty, while losers were JSW Steel, Infosys, Bajaj Auto, Tech Mahindra, and Asian Paints.

Amidst sector, the biggest gainers included oil & gas, realty, capital goods, and PSU bank indices, which closed 2-4 percent higher.

In a report on November 24, analysts at Motilal Oswal had hinted that the BJP-led NDA’s electoral win could help boost investor sentiment. “This poll result, coupled with improving rural demand post a good monsoon and expected strong Kharif output, could set the stage for a mini risk-on rally,” Motilal Oswal said.

In an article Moneycontrol wrote, Kotak AMC’s Nilesh Shah had noted that the election results could boost the confidence in the government’s ability to push through reforms. “It could also help restore foreign investor confidence, as many foreign investors had been aggressively selling over the past two years and were underweight on India,” he had said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. NarayanVentures advises users to check with certified experts before taking any investment decisions.